Sometimes your best isn’t enough. That’s a lesson Nvidia (NVDA) learned Wednesday after the company’s stock price fell 3% despite posting better-than-expected second-quarter earnings and guidance for the fourth quarter. three.

As if the company’s growth wasn’t impressive either. Revenue rose 122% year over year to $30 billion, from $13.5 billion. Nvidia’s data center revenue rose to $26.3 billion, an increase of 154% year-on-year.

But that was not the kind of explosion that investors have quickly become accustomed to in the past few quarters.

In addition to investor sentiment, Wall Street analysts also seem to have picked up on Nvidia’s growth following a series of surprises that hit the top.

Nvidia’s revenue reported on Wednesday beat Wall Street expectations by 4.1%, the lowest rate since the fourth quarter of its 2023 fiscal year.

As Nvidia’s business has grown over the past two years, the company’s revenue has exceeded Wall Street forecasts by more than double the percentage for three straight quarters, including a 22% difference in its fourth quarter. second fiscal year 2024.

And while Wall Street appears to have a better outlook for Nvidia’s growth this AI investment cycle, questions have also been raised about Nvidia’s next-generation Blackwell chip status.

Before the company’s earnings announcement, Information reported that the chip, which follows the Nvidia Hopper line, is facing delays that could affect some of the company’s biggest customers including Microsoft and Google.

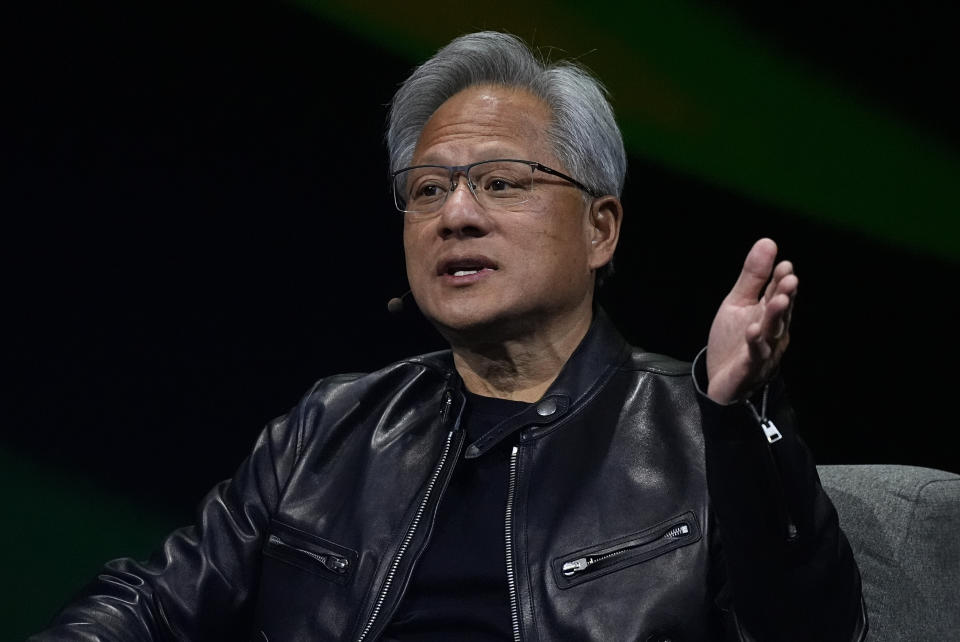

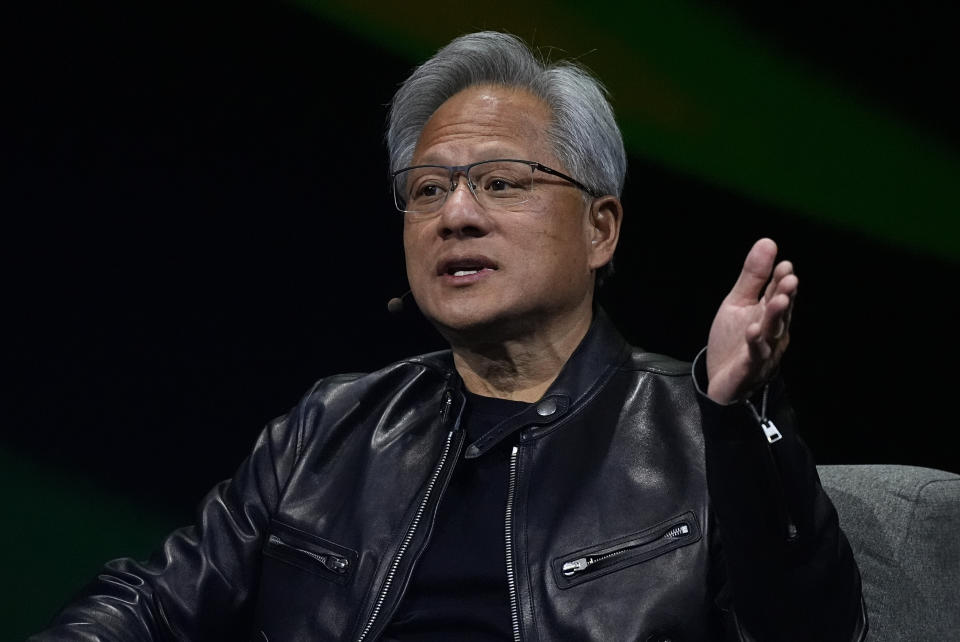

In her quarterly comments, Nvidia CFO Colette Kress explained that the company has made changes to Blackwell to improve its manufacturing capabilities. Meanwhile, CEO Jensen Huang said the chip is being sampled to customers, a major step toward mass-marketing the processor.

Huang said the company expects to post several billion dollars of Blackwell’s revenue in the fourth quarter. But the CEO was unable to specify exactly how much revenue Blackwell will generate, despite questions from analysts.

However, Huang provided some strong points for Nvidia, including pointing out that demand for Blackwell’s platforms is outstripping supply. The CEO also said that the Nvidia Hopper platform will continue to grow in the second half of the year, and explained that the company expects its data center business to grow “significantly next year.”

Huang also said that AI innovation is driving the company’s data center revenue. Inferencing refers to computers running AI programs and providing users with answers to their questions.

That should put fears of threats to Nvidia’s long-term growth as companies move from training AI models to using emotions. Huang seems to believe that Nvidia will continue to advance as customers use its chips to train and run their own AI models.

Nvidia is still the world leader in AI chips, and it will take time before the players AMD (AMD) and Intel (INTC) catch up to its hardware and software. And while Nvidia may be facing a near-term stock price drop, Wall Street remains bullish.

In an investor note released after Nvidia’s earnings, BofA’s Vivek Arya raised his price target on the chip maker to $165 from $150 a share, writing, “Despite the noise in the quarter, we still believe [Nvidia’s] exceptional growth opportunity, performance and a large share of 80%+ as AI product offerings are still their first 1-1.5. [years] of at least 3 to 4 years of initial investment. “

Srini Pajjuri of Raymond James also raised the firm’s price target on Nvidia stock from $120 to $140, writing in a note to investors that “Blackwell’s prospects appear to be better than feared and management they strongly predict FQ4.”

Pajjuri also said that demand for Nvidia’s latest Hopper chip continues to be healthy and pointed to sales growth expected in Q4, although Blackwell’s production is rising at the same time.

Morgan Stanley’s Joseph Moore, who raised his price target on Nvidia from $144 to $150, called Nvidia’s sky-high expectations for the company’s move after the report of the salary.

“Expectations become more difficult as higher levels become more common, but this was still a very strong quarter given the current changing environment.”

Whether that is enough to satisfy investors next quarter remains to be seen.

Email Daniel Howley at dhowley@yahoofinance.com. Follow him on Twitter at @DanielHowley.

For the latest earnings reports and analysis, earnings rumors and forecasts, and company earnings news, click here

Read the latest financial and business news from Yahoo Finance.

#Nvidias #business #growing #faster #expected #Investors #disappointed